The $3.1M Singapore Inheritance Disaster

In 2019, three Singapore siblings discovered something shocking after their father passed away.

Their parents had clear, written wills leaving two properties—a semi-detached house and a shophouse worth $3.1 million—to their youngest brother.

But years earlier, their parents added the eldest son as a "joint tenant" to get a longer bank loan.

Under Singapore law: Joint tenancy means the surviving owner automatically inherits the property—regardless of what the will says.

Despite both parents' clear wishes... the eldest son legally became sole owner.

The youngest son and sister sued. The eldest claimed he was the "favourite" because he graduated from Cambridge.

Three years of bitter legal battles. Family relationships destroyed. Massive court fees.

"A will alone cannot over-ride the eligibility of surviving joint owners to inherit the whole property."

— Justice Philip Jeyaretnam, Singapore High Court (2023)

The family eventually won in court. But at what cost?

Having insurance and a will is NOT enough. Without proper estate planning, even clear intentions lead to legal battles, destroyed relationships, and drained resources.

But Legal Fairness Doesn't Always Equal Emotional Fairness

Here's another family where estate planning failed—not because of legal mistakes, but because they ignored the emotional side.

A successful grandfather built a thriving business. He had two sons: Son A with two children (A1 and A2), and Son B with one child (B1).

When he passed, he divided his shares equally: 50% to Son A, 50% to Son B. Legally perfect.

But when the next generation inherited:

- A1 got 25%

- A2 got 25%

- B1 got 50%

The problem? All three grandchildren grew up together. Same house. Same meals. Same family business. They considered themselves equals.

But suddenly, B1 owned DOUBLE what A1 and A2 each owned.

A1 and A2 felt it was deeply unfair. Resentment built. They started seeing B1 as "privileged" rather than family.

The family unity their grandfather worked so hard to build... was destroyed.

"When families fail to address emotional fairness alongside financial fairness, misunderstandings arise, eroding the unity the legacy was meant to sustain."

— Dr. Sanjay Tolani, Wealth Infrastructure

Proper estate planning addresses BOTH legal correctness AND emotional fairness. It's not just about dividing assets—it's about preserving family relationships.

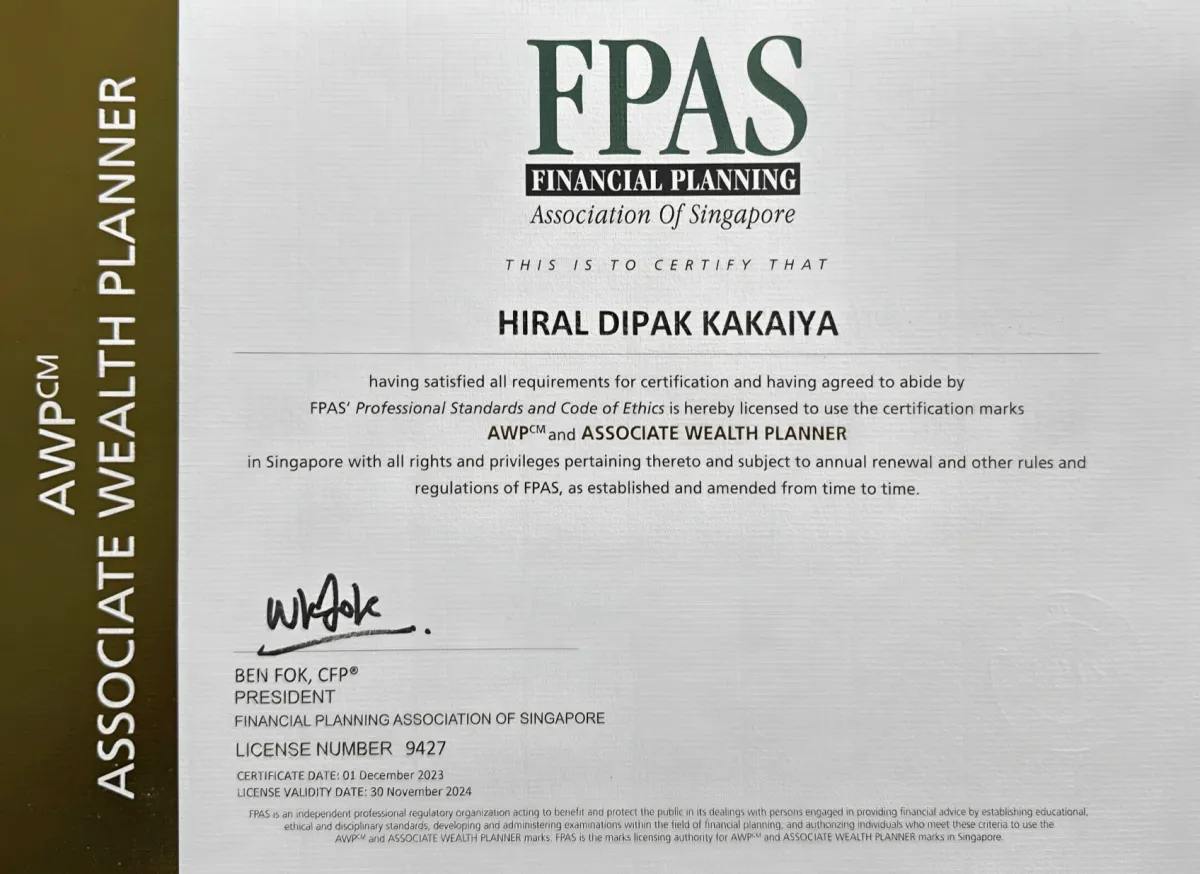

Hi, I'm Hiral Kakaiya

I came to Singapore in 2009 and discovered my passion for financial planning. Over the years, I've committed myself to continuous education—earning my Associate Wealth Planner (AWP) certification and, 3 years ago, becoming a Certified Estate Planner (CEP).

That deep dive into estate planning revealed the shocking gaps most Singapore families have in protecting their wealth and relationships. Today, I've worked with 300+ families to prevent disasters like the ones above using the proven frameworks you're about to see.

The 7 Hidden Losses Your Will Can't Prevent

Your Family Protection Score

Most wills protect against 1-2 losses.

The 3P Framework protects against all 7.

The 3P Framework That Protects Against All 7 Losses

PASS DOWN

Ensure smooth wealth transfer without legal battles or family disputes (prevent the $3.1M disaster)

PRESERVE

Protect assets from creditors, poor decisions, and sudden wealth syndrome using trust structures

PROLONG

Create structures that protect wealth AND family harmony for multiple generations

The Wealth Infrastructure Methodology

I'm certified in Dr. Sanjay Tolani's Wealth Infrastructure framework—the same systematic approach used by affluent families worldwide.

This methodology addresses both the technical risks and emotional dynamics that determine whether wealth truly lasts.

"The best asset structuring goes beyond financial engineering—it nurtures the bonds, wisdom, and values that keep a family united for generations."

— Dr. Sanjay Tolani, Inter-Generational Wealth Planning Expert

Most advisors focus only on risk management. I address both—which is why my clients avoid disasters like the $3.1M court battle and the 25%-25%-50% emotional divide.

Who We Protect Using The F.B.I. Framework

What Singapore's Top Executives Say

Leaders from Microsoft, Anglo Ardmore & Real Estate Trust Us

Hiral's deep knowledge in estate and financial planning opened my eyes to gaps I hadn't even considered. His professional and empathetic approach made the entire process smooth and stress-free.

Hiral's expertise truly stands out. His comprehensive analysis gave me a clear path forward with practical solutions aligned perfectly with my goals. His professionalism makes him an invaluable advisor.

Hiral helped me understand the importance of integrating financial and estate planning. His guidance was insightful and personalized. His patience in explaining details made this a game-changer for my financial legacy.

Apply For Your 1-on-1 Estate Planning Consultation

Due to the time-intensive nature of consultations, applications are subject to approval only

Your Consultation Includes:

Don't Let Your Family Face The Same $3.1M Disaster

Remember: Having a will is not enough. Without the 3P Framework, your family faces all 7 losses—especially the loss of relationships that money can't fix.

Secure Your Family's Future Now →